We are all familiar with the concept of inflation. All other factors being equal higher interest rates in a country increase the value of that countrys currency relative to nations offering lower interest rates.

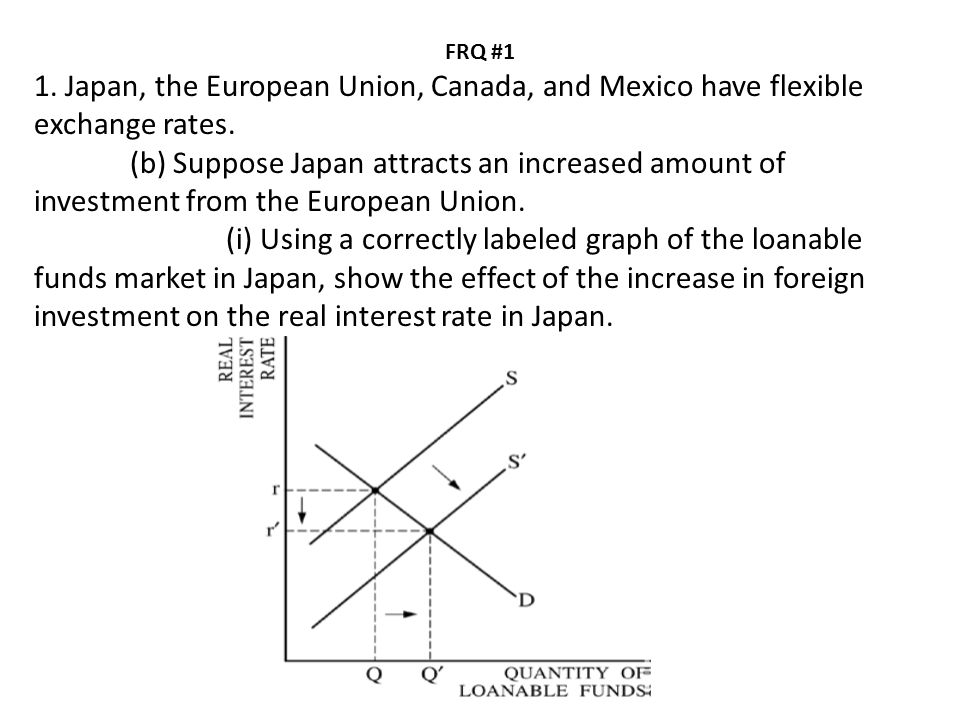

International Trade And Foreign Exchange Markets Ppt Video Online

International Trade And Foreign Exchange Markets Ppt Video Online

As the fed funds rate rises interest rates on other bonds will rise to remain competitive.

The whole process is long and complicated but it works something like this. The bank of england boe governor mark carney said that more relaxed monetary policy might be needed to boost the pace of economic growth in the uk after the decision to leave britain from the european union or what we know as brexit. An enormous advantage of having access to a forex trading account is that you can invest your money in foreign currencies that pay interest.

It offers a lower interest rate than other bonds. The current expectations for the us federal funds rate changes i! n 2019 are quite diverse from a rate hike possibility accordin! g to the latest as of april 29 projections materials released by the fomc to a hold sentiment expressed by experts surveyed by the wall street journal to a higher than 60 probability of at least one rate cut according the fed funds futures rates on cme. The next rate announcement from the boe is expected on june 20 but it remains to be seen if the central bank will change interest rates then.

Interest rates are crucial to day traders in the forex market because the higher the rate of return the more interest is accrued on currency invested and the higher the profit. Its time for the fed to raise interest rates. The difference between the two interest rates known as the interest rate differential is the key value to keep an eye on.

You being the uk investor are not alone in investing in the country with higher. Saunders also cautioned against waiting till it was too late to hike rates when inflation from all quarters of the economy! showed signs of trouble. Interest rates in the us are on the rise so you start to buy us dollars to invest in the us government bonds.

The interest rate differential works out when you find a country that has a low interest rate to sell. The fed decides that it needs to raise interest rates because it needs to stimulate a sluggish economy and curb inflation. But if you resell your bond it will be worthless.

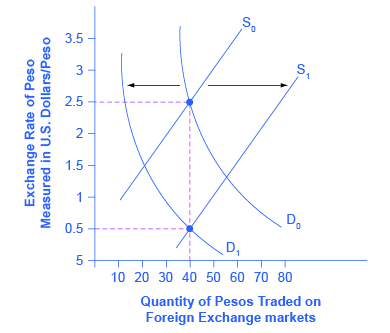

29 2 Demand And Supply Shifts In Foreign Exchange Markets

29 2 Demand And Supply Shifts In Foreign Exchange Markets

Nima Forex Rates Rise Financial Tribune

Nima Forex Rates Rise Financial Tribune

Fed Interest Rate Rise Comes Under Fire From Trump Forex News Shop

Fed Interest Rate Rise Comes Under Fire From Trump Forex News Shop

International Trade And Foreign Exchange Markets Ppt Video Online

International Trade And Foreign Exchange Markets Ppt Video Online

Weekly Currency News Ecb Rate Hike Speculation Boosts The Euro

Weekly Currency News Ecb Rate Hike Speculation Boosts The Euro

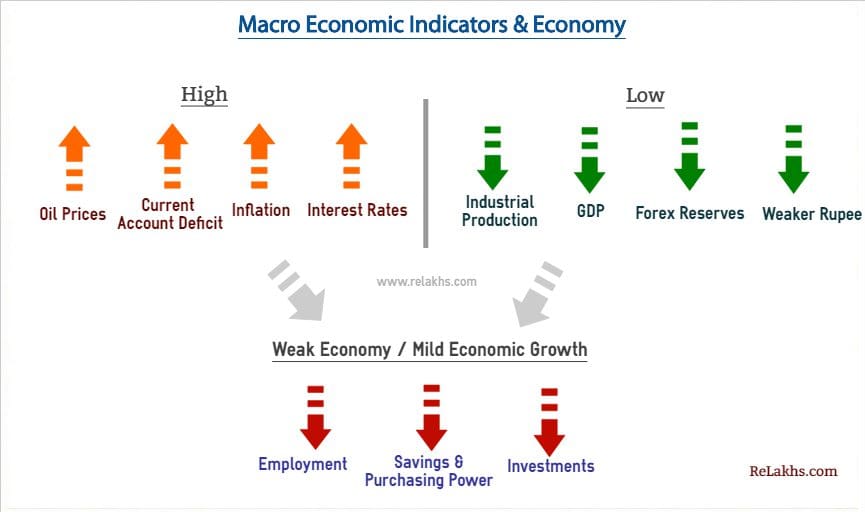

Rbi Hikes Interest Rates In 2018 19 Impact On Your Personal Finances

Rbi Hikes Interest Rates In 2018 19 Impact On Your Personal Finances

Nab May Be Late To The Party But Piles Further Pressure On The Rba

Nab May Be Late To The Party But Piles Further Pressure On The Rba

Snb Takes Boldest Step Yet To Curb Swiss Franc S Rise Sep 6 2011

Snb Takes Boldest Step Yet To Curb Swiss Franc S Rise Sep 6 2011

Why Interest Rates Matter For Forex Traders

Fed To Raise Rates But Dollar Eyes Fomc Forecasts Forex News Preview

Fed To Raise Rates But Dollar Eyes Fomc Forecasts Forex News Preview

Loonie Gains As Boc Leaves Rates Unchanged In A Hawkish Statement

How Do Interest Rates Affect The Forex Market Asktraders Com

How Do Interest Rates Affect The Forex Market Asktraders Com

The Top 3 Intermarket Influences On Currencies Forex Source

Reading The Interest Rates Strategy Forex Fx Leaders

Reading The Interest Rates Strategy Forex Fx Leaders